SIP Investment: SIP investment not only gives good returns, but the ‘power play’ of compounding is such that the returns run twice as fast and makes you a T20 match winner for 20 years.

SIP Investment: These days, there is a cricket fever in the country. IPL Indian Premier League is going on. Lots of fours and sixes are being hit. But, have you been bowled out on the investment pitch? If you are also looking for a batsman who can hit fours and sixes, then SIP is the right choice. SIP investment not only gives good returns, but the ‘power play’ of compounding is such that the returns run twice as fast and make you a T20 match winner i.e. a 20-year match winner. If you understand the power of compounding, then no obstacle will come in your way to becoming rich. Before investing anywhere, it is important that you do financial planning. The sooner you start investing, the more benefits you will get. Investment should be for a long period. Let’s understand…

What is Compounding?

Power of Compounding: It is taught in school in childhood. But, in reality, only an investor understands its power. To understand in a simple way, the interest you get on investing is called compounding. Along with the principal, interest is also received on its interest. Compounding can double or triple your investment. This is what works in mutual fund SIP.

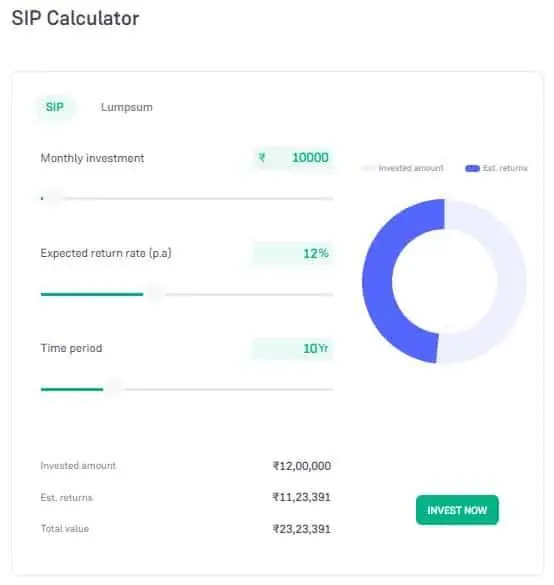

SIP of Rs. 10,000 for 10 years

– Estimated return: 12% p.a.

– Investment period: 10 years

– Total investment: ₹12,00,000

– Total SIP value: ₹23,23,391

– Profit: ₹11,23,391

SIP investment of 10 thousand for 15 years

Estimated return: 12% per annum

Investment period: 15 years

Your total investment: ₹18,00,000

Total value of SIP: ₹50,45,760

Profit: ₹32,45,760

SIP investment of Rs 10,000 for 20 years

– Expected return: 12% per annum

– Investment period: 20 years

– Your total investment: ₹24,00,000

– Total value of SIP: ₹99,91,479

– Profit: ₹75,91,479

The ‘Power Play’ of Compounding

The power of compounding will be understood only when you start investing from a young age. The more time you give to your investment, the more benefit you will get. Compounding will be more on investing for 20-25 years instead of 5-10 years.