Small Savings Schemes: Besides the traditional investment option of fixed deposits, retail investors can — and often do – explore investing in small savings schemes. These are also known as post office savings schemes.

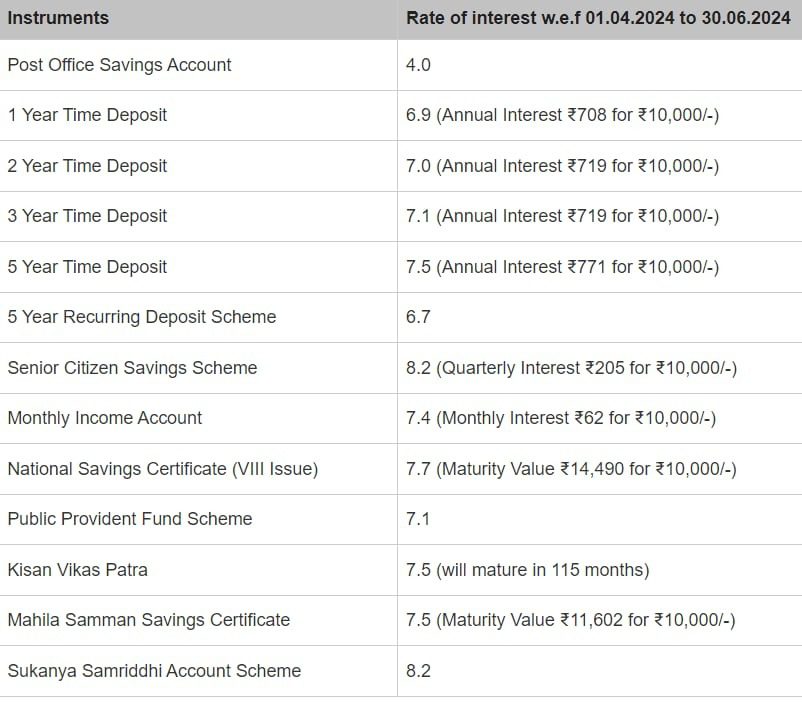

These investment products offer interest in the range of 4 to 8.2 percent per annum. The lowest rate of interest of 4 percent is offered by a post office savings account while the highest rate of 8.2 percent is offered by Sukanya Samriddhi Account.

Here we list out each of these products in detail:

- Post Office Savings Account: This can be opened with a minimum ₹500 with no maximum deposit. Interest is calculated on the basis of minimum balance between 10th and end of the month.

- National Savings Recurring Deposit Account: The National Savings Recurring Deposit account can be opened with a minimum investment of ₹100 or any amount in the multiples of ₹10. There is no maximum limit.

- National Savings Time Deposit: The National Savings Time Deposit Account is of one year, two years, three years and five years. The minimum amount for opening an account is ₹1,000 and multiple of ₹100 while there is no maximum limit.

- National Savings Monthly Income Account: The National Savings Monthly Income Account can be opened with a minimum investment of ₹1,000 while the maximum investment limit is ₹9 lakh in single account and ₹15 lakh in joint account.

- Senior Citizens Savings Scheme Account: One is supposed to make only one deposit in the account in multiples of ₹1,000 while not exceeding ₹30 lakh.

- Public Provident Fund Account: The minimum investment inPPFis ₹500 while the maximum is ₹1,50,000 in a financial year. These deposits can be made in lump-sum or in instalments.

- Sukanya Samriddhi Account: Minimum deposit one can make is ₹250 and maximum is ₹1.5 lakh in a financial year. The subsequent deposits can be made in multiples of ₹50 and deposits can be made in lump-sum. There is no limit on the number of deposits either in a month or in a financial year.

- National Savings Certificate: The minimum investment in NSC of ₹1,000 can be made and in multiples of ₹100, while there is no maximum limit.

- Kisan Vikas Patra: The minimum investment of ₹1,000 can be made and in multiples of ₹100 with no maximum limit.

- Mahila Samman Savings Certificate: One can make a minimum investment of ₹1,000 and multiple of ₹100 in Mahila Samman Savings Certificate with a maximum limit of ₹2 lakh in an account.

Note: This story is for informational purposes only. Please speak to a SEBI-registered investment advisor before making any investment related decision.