FM Nirmala Sitharaman made a big announcement in Budget 2025, giving great relief to the middle class and making income of Rs 12.75 lakh tax free.

Tax Free Income: A big announcement has been made in the first full budget of Modi 3.0, giving relief to the middle class. In her budget speech, Finance Minister Nirmala Sitharaman has made income up to Rs 12 lakh tax free. Along with this, the benefit of standard deduction of Rs 75000 will be available. Let us know how much tax will have to be paid on how much income and how much will be saved after the latest changes made by the government in the tax slab?

So much tax on income above 12 lakhs

Nirmala Sitharaman announced the new tax slab in her budget speech and said that now income up to Rs 12.75 lakh has been made tax free. This also includes standard tax deduction. After this decision of the government, the middle class will now have more money in their hands. Talking about the calculation of tax after this big change in the tax slab, there is zero tax from 0 to 12 lakhs. But if the income is Rs 13 lakh, then from here onwards the income up to Rs 16 lakh will come in the tax slab of 15 percent.

How much tax on salary

0 tax up to 4 lakhs

5% up to 4-8 lakhs

10% up to 8-12 lakhs

15% up to 12-16 lakhs

20% up to 16-20 lakhs

25% up to 20-24 lakhs

30% on income above 24 lakhs

25% tax slab introduced

In the changes made by the government in the income tax slab, a new tax slab of 25% was introduced by Finance Minister Nirmala Sitharaman. If we look at the new tax slab, now 20% tax will be applied on income from Rs 16 to 20 lakh. At the same time, 25% tax will be levied on income from Rs 20 lakh to Rs 24 lakh and 30% tax will be levied on income above this.

Calculation of savings?

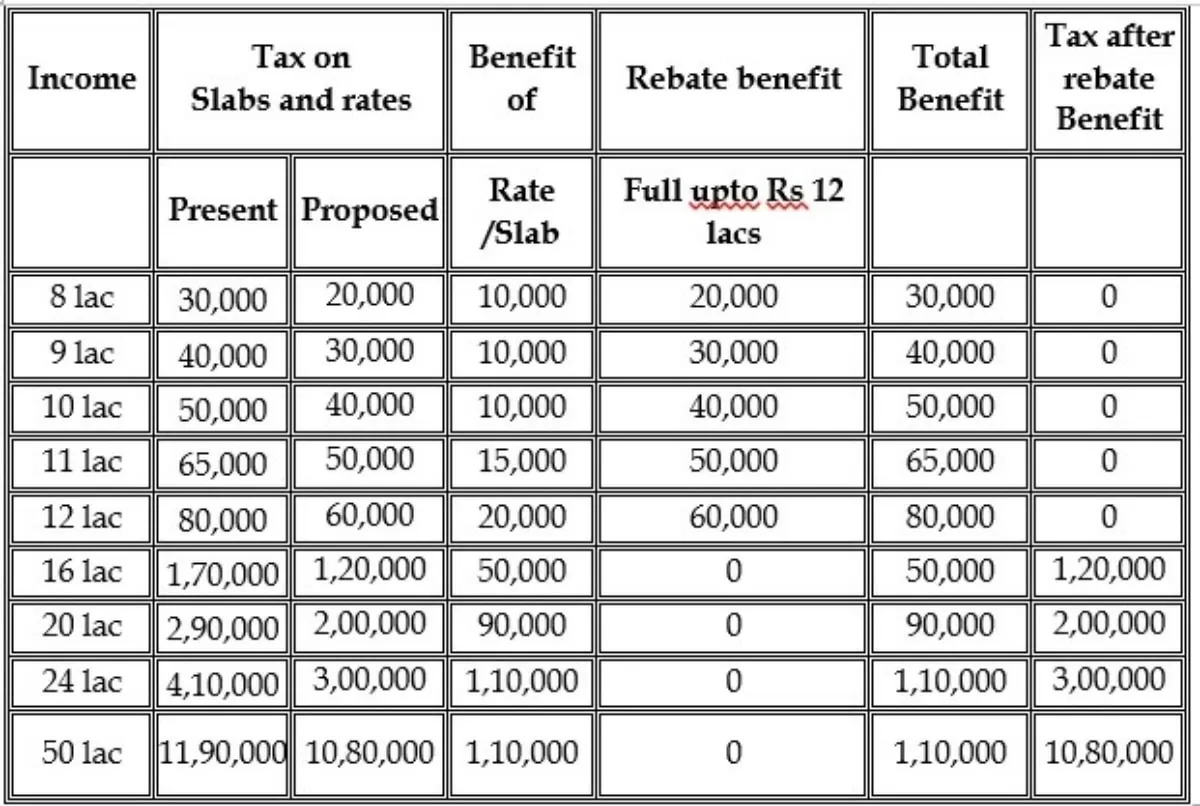

According to the new tax slab, if you earn up to Rs 12 lakh, you will now save Rs 80,000. Understand this as an example, under the old tax slab, if a person’s salary was Rs 12 lakh, then he would have to pay a tax of Rs 80,000, but after the latest changes in the tax slab, it has now become zero. According to the new tax slab, you will save Rs 50,000 on an income of Rs 16 lakh, and if you earn Rs 18 lakh now, then you will save Rs 70,000. You will save Rs 90,000 on an income of Rs 20 lakh and Rs 1.10 lakh on an income of Rs 25 lakh and above.

How different is the new slab from the old tax slab

Last year also the government had changed the tax slab under the New Tax Regime in the budget and now it has again made a big change in it.

New tax slab (2025)

0 to 4 lakh rupees – no tax

4-8 lakh rupees – 5%

8 to 10 lakh rupees – 10%

12 to 16 lakh rupees – 15%

16 to 20 lakh rupees – 20%

20 to 24 lakh rupees – 25%

On income above 24 lakh – 30%

Old tax slab (2024)

Rs 0 to 3 lakh – No tax

Rs 3 to 7 lakh – 5 per cent

Rs 7 to 10 lakh – 10 per cent

Rs 10 to 12 lakh – 15 per cent

Rs 12 to 15 lakh – 20 per cent

More than 15 lakh – 30 per cent

Understand how Rs 32500 will be saved on earning 15 lakhs

If your income is Rs 15 lakhs, then under the old tax regime, after the deduction benefit of Rs 50,000, the income tax comes to Rs 2,57,400. However, in this you can take advantage of 80c, medical insurance, NPS and home loan. But if we talk about the new tax regime, then according to the new tax regime applicable for the year 2024-24, the income tax on an income of 15 lakhs is Rs 1,30,00. Whereas according to the new tax regime presented in Parliament today, the income tax is Rs 97,500. According to this, only the change in the new tax regime will save about Rs 32500 for those with an income of 15 lakhs.

First of all, if we deduct Rs 75000 of standard deduction from the income of 15 lakhs, then the amount of income under the scope of income tax remains Rs 14.25 lakh. After that, calculate the tax according to the proposed new tax slab-2025.

After deducting standard deduction….

1500000 – 75000 = Rs 14,25000

0–4 0% = 0

4–8 5% = 20,000

8–12 10% = 40,000

12–16 15% 4 = 33,750

(Note: In the slab of 12 to 16 lakh, the income of those earning 15 lakhs is reduced to Rs 2.25 lakh, on which 15 percent income tax is applicable. Accordingly, the income tax on an income of 15 lakhs is Rs 93750, on which there is a provision of 4 percent cess separately, which is Rs 3750. In this way, the total income tax is Rs 97500.)

Now let’s talk about the new tax regime applicable for the year 2024-25. According to that, if we calculate the tax on an income of 15 lakhs, then the total income tax comes to Rs 130000. Know how? In this also, the benefit of standard deduction of Rs 75 thousand will be available. After which the taxable income will be Rs 14.25 lakh.

₹0-₹3 lakh: Zero = 0

₹3-₹7 lakh: 5% = 20,000

₹7-₹10 lakh: 10% = 30,000

₹10-₹12 lakh: 15% = 30000

₹12-₹15 lakh: 20% = 45000

According to this, the income tax comes to Rs 125000, after adding 4% cess to which the total income tax comes to Rs 130000. This means that people earning Rs 15 lakhs will save Rs 32500 in income tax just by changing the slab of the new tax regime.