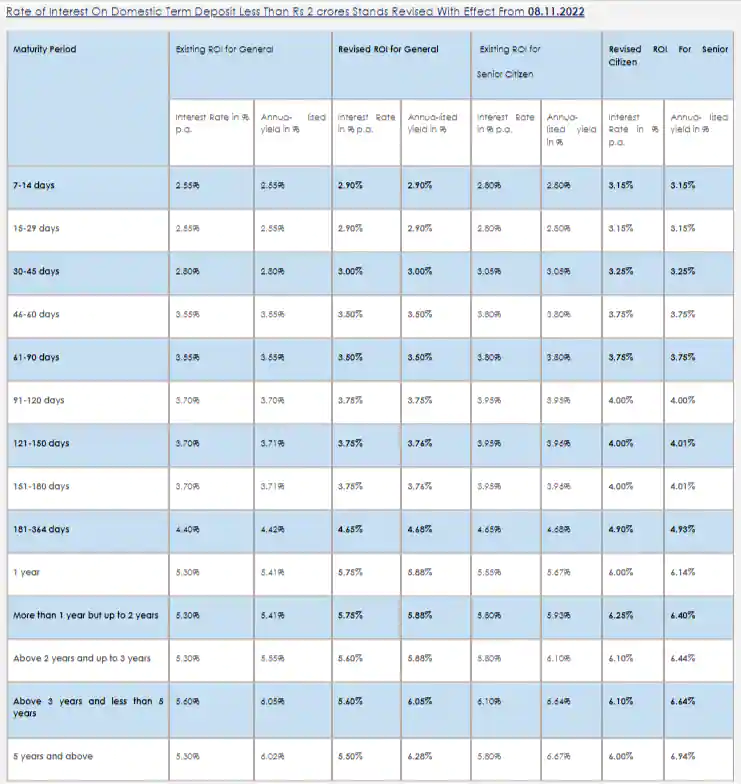

FD interest rates hikes: UCO Bank, one of the leading public sector lenders, raised the interest rate on fixed deposits under ₹2 crore. According to the bank’s official website, the revised rates took effect on November 8, 2022. The bank increased FD interest rates in response to the modification by up to 45 bps. On FDs maturing in 7 days to 5 years and above, the bank is now offering an interest rate ranging from 2.90% to 5.50% for the general public and 3.15% to 6.00% for senior citizens. “Rate of Interest On Domestic Term Deposit Less Than ₹2 crores Stands Revised With Effect From 08.11.2022,” mentioned UCO Bank on its website.

UCO Bank FD Rates

On FDs maturing in 7-29 days, the bank has hiked the interest rate by 35 bps from 2.55% to 2.90% and on those maturing in 30-45 days, UCO Bank has hiked the interest rate by 20 bps from 2.80% to 3.00%. UCO Bank is now offering an interest rate of 3.50% on FDs maturing in 46-90 days and the bank has hiked the interest rate by 5 bps from 3.70% to 3.75% on FDs maturing in 91-180 days.

Deposits maturing in 181-364 days will now offer an interest rate of 4.65% which was earlier 4.40% a hike of 25 bps and those maturing in 1 year but up to 2 years will now fetch an interest rate of 5.75% which was earlier 5.30% a hike of 45 bps. For FDs expiring in more than two years and up to three years, the bank increased interest rates by 30 basis points from 5.30% to 5.60%, while UCO Bank is offering an interest rate of 5.60% for FDs maturing in more than three years and less than five years. On FDs maturing in 5 years or more, UCO Bank increased interest rates by 20 basis points, from 5.30% to 5.50%.

To Staff/Ex-staff, UCO Bank is offering an additional interest rate of 1.00% and to Ex Staff Senior citizens, the bank offers an additional interest rate of 1.50%.

UCO Bank has launched two special term deposit products UCO 444 & UCO 666. As the name suggests, the period of deposit comes with 444 days & 666 days. The scheme will be valid till 31-12-2022. To open this special FD scheme, a minimum deposit amount of ₹10000 / (thereafter in multiples of ₹1000 ) with a maximum limit of less than ₹2 Crore is required. The rate of interest applicable is 5.65 % for UCO 444 & 5.75% for UCO 666 and the interest will be compounded quarterly.

On “UCO 444″ deposit scheme, senior citizens will get an interest rate of 6.15 %, Staff will get an interest rate of 6.65 % and Ex. staff & Sr. citizens will get an interest rate of 7.15 %. Whereas on “UCO 666″ deposit scheme, senior citizens will get an interest rate of 6.25 %, Staff will get an interest rate of 6.75 % and Ex. staff & Sr. citizens will get an interest rate of 7.25 %. “Senior Citizen/ Staff / Senior Citizen & Ex – Staff shall be allowed additional interest as per the existing norms. The overall ceiling in amount for Ex – staff / Ex staff senior citizen for being eligible for higher rate under the scheme shall be equal to the terminal benefits plus ₹10 Lakh as usual,” mentioned UCO Bank on its website.

The interest rate will be determined using the existing term deposit scheme. There will be the option of a Monthly Income Scheme (MIS) and Quarterly Income Scheme (QIS), according to the bank. The scheme also allows a premature withdrawal option, however, the rate that applies will be 1% lower than the rate that was in effect when the deposit was established by the Bank, or the prevailing rate, whichever is lower.