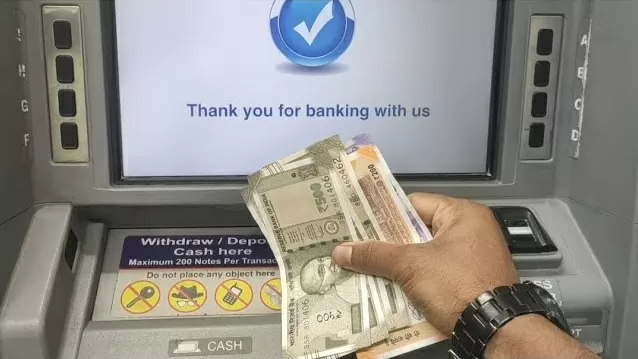

Nowadays, it takes a lot of effort to withdraw cash, because sometimes there is no money in the ATM and sometimes the server remains down. In such a situation, virtual ATM can prove to be very helpful, in which card and ATM are not required.

Virtual ATM: Unified Payment Interface i.e. UPI is quite popular. In such a situation, there is no need for cash. Users make online payments with the help of mobile and internet. In such a situation, people do not carry debit or credit cards. But in many remote areas cash is required, at that time it becomes a lot of problem. In such a situation you will have to search ATM. Many times there is no cash in ATM. Also, it is necessary to have debit and credit cards nearby, but virtual ATM can get rid of all these problems. In this you can take cash from the nearest shopkeep, so let us know how virtual ATM works.

What is virtual ATM?

Chandigarh based fintech company has introduced virtual ATM system. This is a cardless and hardware less cash withdrawal service. It does not require ATM card and PIN.

How to withdraw money from virtual ATM

Smartphone is necessary to withdraw money from virtual ATM. Also mobile banking and internet is required. Then you have to submit a request to withdraw cash from online mobile banking. It is important that the mobile banking app should be registered with the phone number.

The work will be done with OTP

After this, bank generated OTP request will have to be entered. After this you will have to show OTP at PayMart shop. In this way you will be able to collect cash from the shopkeeper. The mobile banking app will show you the shopkeeper list of Virtual Paytm Paymart, in which name, location, phone number will be entered. There will be no need of debit or credit card in this.

Who will be able to use virtual ATM?

Virtual ATM has partnered with IDBI Bank, Indian Bank, Jammu Kashmir Bank and Karur Bank. At present, Virtual ATM is available in selected locations Chandigarh, Delhi, Hyderabad, Chennai, Mumbai. Which will be rolled out across the country by March. Also the company is in touch with many other banks.

How much money can be withdrawn?

You can withdraw a minimum of Rs 100 and a maximum of Rs 2,000 from a virtual ATM. Its monthly limit is Rs 10 thousand.